This program is getting shut down early by Congress, so I've removed the contact form.

I'm now working with a company that is going to overturn a huge area of health / medicine with AI. It has a free affiliate program, but there is a huge EQUITY (stock) opportunity for those who invest a few hundred dollars and do minimal work for the company. This includes getting a % of global contracts and ad revenue from their apps;

This is a LIMITED-TIME window, that may be gone sometime in the spring of 2024. Click here for more information.

I'm now working with a company that is going to overturn a huge area of health / medicine with AI. It has a free affiliate program, but there is a huge EQUITY (stock) opportunity for those who invest a few hundred dollars and do minimal work for the company. This includes getting a % of global contracts and ad revenue from their apps;

This is a LIMITED-TIME window, that may be gone sometime in the spring of 2024. Click here for more information.

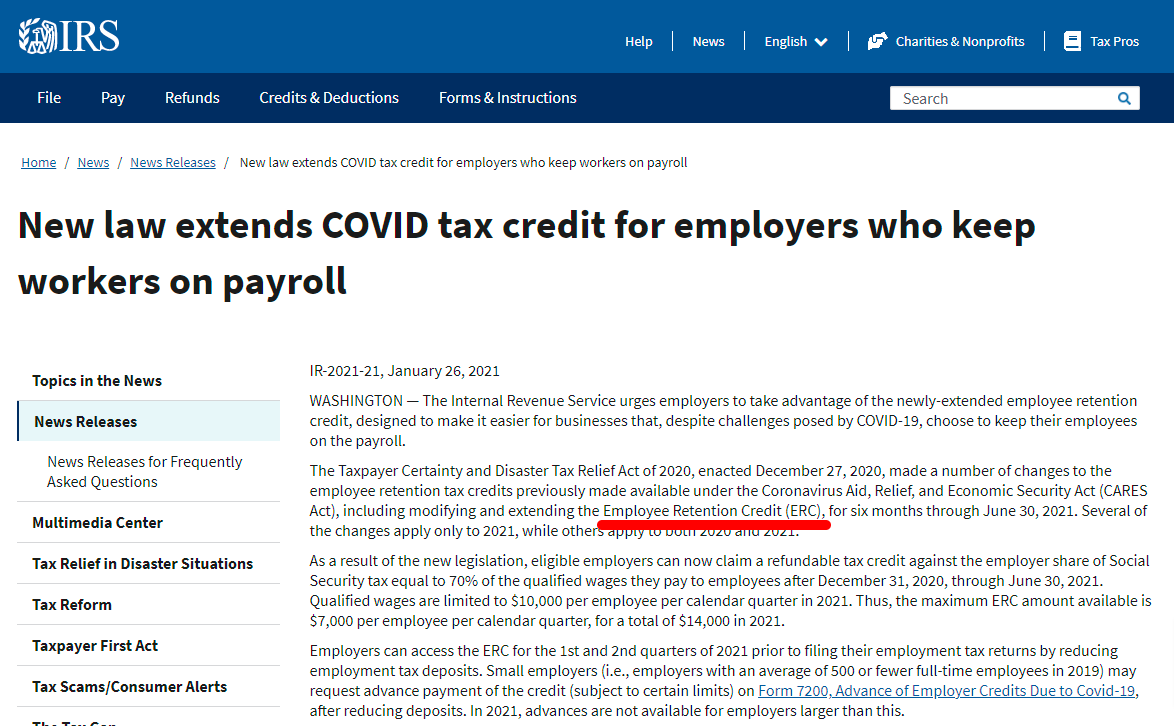

What is ERC?

Did you ever hear of coronavirus? Did you ever notice the government was throwing HUGE sums of money into the economy to fix all the damage of shutdowns, social distancing, and supply chain issues?

There is currently over $1 TRILLION available to businesses that were impacted in any way by the pandemic through the Employee Retention Credits (ERC) program. A business can get up to $26,000 per eligible W2 employee. They simply have to file with the IRS to receive a check from the government.

But most businesses don't know about this program, or feel it's too complex to file, or have been told they don't qualify for an ERC refund. So they are potentially ignoring hundreds of thousands of dollars, or even millions.

And that's where you come in.

There is currently over $1 TRILLION available to businesses that were impacted in any way by the pandemic through the Employee Retention Credits (ERC) program. A business can get up to $26,000 per eligible W2 employee. They simply have to file with the IRS to receive a check from the government.

But most businesses don't know about this program, or feel it's too complex to file, or have been told they don't qualify for an ERC refund. So they are potentially ignoring hundreds of thousands of dollars, or even millions.

And that's where you come in.

Help Businesses Get Their Refunds

If you can tell businesses that you'd like to help them earn up to $26,000 per W2 employee, and that there is no risk to them, and successfully get them interested in this idea ... then you have the opportunity to earn SUBSTANTIALLY.

Businesses need 10-500 W2 employees. The best businesses to approach are those obviously affected by the pandemic, like restaurants, movie theaters, etc., but any business may have been impacted.

Your job is NOT to file for them. You are simply referring them to a licensed CPA firm that specializes in this filing in order to maximize the refund to the business. This firm has filed for thousands of businesses and has brought in nearly $3 BILLION in refunds at the time of this writing. They average hundreds of thousands of dollars per business in refunds.

Conservatively, let's say you successfully refer just ONE BUSINESS per month to this CPA firm, and the firm "only" gets them a refund of $150,000.

The business pays AFTER they receive a check from the IRS. They pay 20% of their refund to the CPA firm.

In this example, you would earn $6000 in commissions.

For most people, that would be a nice full-time income. Now what happens if you refer 2 of those per month, or you refer just one business per month that gets a check for $300,000? In these cases, you would earn $12,000 in commissions. PER MONTH.

Getting the idea? Do you see why this is 100% legit? (Government program + licensed CPA firm.)

Yes, a business CAN file on its own. Or have its existing accountant / CPA firm do so. So we're not claiming some voodoo magic here. This is REAL.

But they're likely to walk away with less money if they work with someone else. I have vetted this deeply and believe this approach will help them to maximize what they receive.

Importantly, this is not a loan. The business does NOT have to pay this back.

Businesses need 10-500 W2 employees. The best businesses to approach are those obviously affected by the pandemic, like restaurants, movie theaters, etc., but any business may have been impacted.

Your job is NOT to file for them. You are simply referring them to a licensed CPA firm that specializes in this filing in order to maximize the refund to the business. This firm has filed for thousands of businesses and has brought in nearly $3 BILLION in refunds at the time of this writing. They average hundreds of thousands of dollars per business in refunds.

Conservatively, let's say you successfully refer just ONE BUSINESS per month to this CPA firm, and the firm "only" gets them a refund of $150,000.

The business pays AFTER they receive a check from the IRS. They pay 20% of their refund to the CPA firm.

In this example, you would earn $6000 in commissions.

For most people, that would be a nice full-time income. Now what happens if you refer 2 of those per month, or you refer just one business per month that gets a check for $300,000? In these cases, you would earn $12,000 in commissions. PER MONTH.

Getting the idea? Do you see why this is 100% legit? (Government program + licensed CPA firm.)

Yes, a business CAN file on its own. Or have its existing accountant / CPA firm do so. So we're not claiming some voodoo magic here. This is REAL.

But they're likely to walk away with less money if they work with someone else. I have vetted this deeply and believe this approach will help them to maximize what they receive.

Importantly, this is not a loan. The business does NOT have to pay this back.

Contact form removed because Congress has closed this program early.